Business news for the stock market

OMRON Corporation: Notice Regarding Disposal of Treasury Stock

Kyoto (pta027/28.02.2023/12:49 UTC+1)

Notice Regarding Disposal of Treasury Stock as Medium-term Incentive Plan Using Employee Stock Ownership Plan Trust

OMRON Corporation (TOKYO: 6645; ADR: OMRNY) announces that at a meeting of Board of Directors held today (February 28, 2023), it resolved to introduce a medium-term incentive plan (hereinafter, the "Plan") using an Employee Stock Ownership Plan (ESOP) trust, targeting manager class employees of OMRON Corporation's overseas subsidiaries, and to dispose of treasury stock through a third-party allotment (hereinafter, the "Treasury Stock Disposal" or "Disposal"), with the ESOP trust account as the scheduled allottee, as described below.

1. Outline of the Disposal

| (1) | Date of disposal | May 31, 2023 |

| (2) | Class and number of shares to be disposed of | 5,904 shares of common stock of OMRON Corporation |

| (3) | Disposal price | 7,213 yen per share |

| (4) | Total value of disposal | 42,585,552 yen |

| (5) | Method of disposal (Scheduled allottee) | Third-party allotment (The Master Trust Bank of Japan, Ltd. (ESOP Trust account): 5,904 shares) |

| (6) | Other | The Treasury Stock Disposal is subject to effectuation of a Securities Registration Statement pursuant to the Financial Instruments and Exchange Act. |

2. Purpose and Reasons for the Disposal

Based on its new long-term vision "SF2030," which was announced on March 1, 2022, OMRON Corporation will conduct business management in which management and employees will join hands with shareholders to improve corporate value toward realizing the "maximization of corporate value (financial value + non-financial value)" and share the achievements among one another. As part of such efforts, OMRON Corporation resolved to adopt the Plan to provide the manager class employees of overseas subsidiaries, who are subject to the Plan (hereinafter, the "Eligible Employees"), with opportunities for acquiring the Plan's shares (OMRON Corporation's common stock) so as to heighten their willingness to achieve performance targets of the medium-term management plan and to raise their motivation toward contributing to the continuous improvement of corporate value (share value) of the OMRON Group by encouraging the Eligible Employees to hold OMRON Corporation shares.

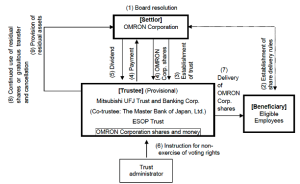

The Plan adopts the scheme of an Employee Stock Ownership Plan (ESOP) trust (hereinafter, the "ESOP Trust"). An ESOP Trust is a trust-based incentive plan based on the ESOP program of the U.S.

The outline of the Plan is as per the Attachment.

In the Treasury Stock Disposal, treasury stock is disposed by way of a third-party allotment to The Master Trust Bank of Japan, Ltd. (ESOP Trust account), a co-trustee of the ESOP Trust agreement entered into by OMRON Corporation and Mitsubishi UFJ Trust and Banking Corporation (hereinafter, the "Trust Agreement"; the trust established under the Trust Agreement is hereinafter referred to as the "Trust") following the introduction of the Plan. The disposal volume is the number of shares expected to be delivered to the Eligible Employees during the trust period in accordance with the share delivery rules. Note that the scale of dilution based on the Treasury Stock Disposal is, when based on the foregoing maximum amount, 0.00% (rounded off to two decimal places; hereinafter the same in the calculation of percentages) against 206,244,872 shares as the total number of issued shares as of September 30, 2022, and is 0.01% against the total number of voting rights that include 1,993,495 of voting rights as of September 30, 2022, reflecting 71 voting rights that increased due to the "Disposal of Treasury Stock as Medium-term Incentive Plan for Employee Stockholding Association Using Restricted Stock" and 118 voting rights that increased due to the "Disposal of Treasury Stock as Stockholding Association Revitalization Plan for Employee Stockholding Association Using Restricted Stock" resolved today.

3. Basis of Calculation and Specific Details of the Disposal Price

To eliminate any arbitrariness in the disposal price, the closing price of OMRON Corporation's common stock on the Prime Market of the Tokyo Stock Exchange on February 27, 2023 (the business day prior to the day of the resolution of the Board of Directors) of 7,213 yen is used as the disposal price. As this is the market price immediately prior to the day of the resolution of the Board of Directors, OMRON Corporation believes that it is rational and not particularly an advantageous price.

Note that the deviation rate (rounded off to two decimal places) of this price from the average closing price of OMRON Corporation shares on the Prime Market of the Tokyo Stock Exchange is as follows.

| Period | Average closing price (any amount less than 1 yen is rounded off) | Deviation rate |

| 1 month (January 30, 2023 to February 27, 2023) | 7,381 yen | -2.28% |

| 3 months (November 28, 2022 to February 27, 2023) | 6,979 yen | +3.35% |

| 6 months (August 29, 2022 to February 27, 2023) | 6,990 yen | +3.19% |

All 4 Audit & Supervisory Board Members (including 2 Outside Audit & Supervisory Board Members) who attended the meeting of the Board of Directors held today have expressed their opinion that OMRON Corporation's process of determining that the foregoing disposal price will not be particularly advantageous to the ESA as the allottee is reasonable, and that such determination is legitimate, in light of the fact that the purpose of the Treasury Stock Disposal is to introduce the Plan and that the disposal price is the closing price on the previous business day immediately preceding the date of the resolution of the Board of Directors.

4. Matters related to procedures under the Code of Corporate Conduct

With regard to the Treasury Stock Disposal, since (1) the dilution rate is less than 25% and (2) it does not involve the change of the controlling shareholder, there is no need to take procedures for acquiring the opinion of an independent third party and confirming the intention of shareholders as set forth in Article 432 of the listing regulations prescribed by the Tokyo Stock Exchange.

(Attachment)

- OMRON Corporation obtains the resolution of the Board of Directors on the introduction of the Plan.

- OMRON Corporation establishes share delivery rules relating to the Plan at the Board of Directors.

- OMRON Corporation establishes the ESOP Trust, with the Eligible Employees who meet beneficiary requirements as beneficiaries.

- In accordance with the instructions of the trust administrator, the ESOP Trust acquires OMRON Corporation shares from OMRON Corporation (disposal of treasury stock) with money contributed in (3) as the source of funds.

- Dividends will be paid on OMRON Corporation shares in the ESOP Trust as with other OMRON Corporation shares.

- Voting rights will not be exercised on OMRON Corporation shares in the ESOP Trust throughout the trust period.

- During the trust period, a certain number of points will be provided to the Eligible Employees at a certain time each year. After the end of the medium-term management plan, the Eligible Employees who meet certain beneficiary requirements will receive a number of OMRON Corporation shares corresponding to the total number of points provided during the trust period that have been adjusted according to the degree of achievement of performance targets, etc.

- If there are any residual shares at the expiry of the trust period, the ESOP Trust will be used continuously by amending the trust agreement and making an additional contribution to the ESOP Trust by resolution of the Board of Directors, or the ESOP Trust will transfer the residual shares without contribution to OMRON Corporation, who plans to cancel the shares by resolution of the Board of Directors.

- The residual assets after being distributed to the beneficiaries at the end of the ESOP Trust will be attributed to OMRON Corporation within the reserve for trust expenses, which is trust funds less share acquisition funds. Any residual assets in excess of the reserve for trust expenses are planned to be donated to an organization that has no vested interest in OMRON Corporation.

Note: When there are no more OMRON Corporation shares in the trust due to the delivery of OMRON Corporation shares to the Eligible Employees who meet the beneficiary requirements, the trust will end before the trust period expires. Note that if the number of shares in the Trust may fall short of the number of shares corresponding to the number of points stipulated (as stipulated in (4) below) for the Eligible Employees during the trust period, or if the money in the trust assets may become insufficient for the payment of trust fees and trust expenses, OMRON Corporation may entrust money to the ESOP Trust additionally as funds for acquiring OMRON Corporation shares, and may acquire OMRON Corporation shares additionally through the ESOP Trust.

[Outline of the Plan]

(1) Establishment of ESOP Trust

OMRON Corporation establishes an ESOP Trust, with the Eligible Employees meeting beneficiary requirements as beneficiaries, for the fiscal years subject to the medium-term management plan of OMRON Corporation. The ESOP Trust acquires from OMRON Corporation the number of OMRON Corporation shares (disposal of treasury stock) expected to be delivered to the Eligible Employees in accordance with the pre-determined share delivery rules. In accordance with the share delivery rules, the ESOP Trust subsequently delivers OMRON Corporation shares according to the degree of achievement of performance targets of the medium-term management plan, etc.

(2) Subjects of the Plan (beneficiary requirements)

The Eligible Employees receive delivery of the number of OMRON Corporation shares corresponding to the number of points (as stipulated in (4) below) from the Trust, subject to meeting the following beneficiary requirements.

(a) The employee is a manager as stipulated by OMRON Corporation and its overseas subsidiaries during the target period.

(b) The employee meets other requirements deemed necessary for achieving the purport of the medium-term incentive plan.

(3) Trust period

The trust period shall be from May 26, 2023 (provisional) to August 31, 2025 (provisional). Note that the Trust may be continued by amending the trust agreement and making additional contribution to the trust upon expiry of the trust period.

(4) Number of OMRON Corporation shares delivered to Eligible Employees

The number of OMRON Corporation shares to be delivered to the Eligible Employees shall be determined as 1 OMRON Corporation share to 1 point according to the number of points calculated by the formula below. Note that if the number of OMRON Corporation shares belonging to the Trust increases or decreases due to a stock split, an allotment of shares without contribution, a reverse stock split, etc., OMRON Corporation will adjust the number of its shares to be delivered per point according to the percentage of the increase or decrease.

The number of points on which the number of shares to be delivered is based shall be the number derived from the following formula in accordance with the evaluation standard set forth by OMRON Corporation.

When calculating points immediately after the end of the medium-term management plan period, the cumulative number of single-year points*1 granted in said medium-term management plan period will be adjusted by a formula set forth below.

Cumulative number of single-year points x performance-linked coefficient*2

*1 20 points each year. However, if the employee becomes subject to the plan in the middle of a target fiscal year, or if the employee ceases to be subject to the plan, the number of points will be adjusted based on the number of months.

*2 A coefficient that varies according to the degree of achievement of performance targets, etc. in the final fiscal year of the OMRON Group's medium-term management plan, calculated by the following formula (maximum: 1.2; minimum: 1.0)

Financial value and non-financial value shall be evaluated at a proportion of 70% and 30%,

respectively, as shown below.

| (1) Financial value | Group consolidated operating income (Increases linearly according to the overachievement rate of medium-term management plan targets) |

| (2) Non-financial value | Selection for inclusion in DJSI World Index ・Selected for two years out of three: 110% ・Selected for three consecutive years: 120% |

Note: (1) will be fixed on the announcement day of full-year results for FY2024.

(2) will be fixed on the announcement day of DJSI World Index in 2024.

(5) Timing of delivery of OMRON Corporation shares to Eligible Employees

The timing of the delivery of OMRON Corporation shares shall be after the end of the medium-term management plan period.

(6) Acquisition method of OMRON Corporation shares by the Trust

The acquisition of OMRON Corporation shares by the Trust shall be an acquisition from OMRON Corporation (disposal of treasury stock).

(7) Exercise of voting rights for OMRON Corporation shares in the Trust

Voting rights shall not be exercised for OMRON Corporation shares in the Trust during the trust period in order to ensure neutrality to management.

(8) Treatment of dividends on OMRON Corporation shares in the Trust

Dividends on OMRON Corporation shares in the Trust will be received by the Trust and used for trust fees and trust expenses of the Trust. If there are any residuals at the end of the trust after being used for trust fees and trust expenses, such residuals will be donated to an organization that has no vested interest in OMRON Corporation. If the Trust will be used continuously, said residual money shall be used as share acquisition funds.

(9) Treatment of residual shares at end of trust period

If there are any residual shares at the expiry of the trust period due to failure to achieve performance targets or other factors, the Trust may be continued by amending the trust agreement and making additional contribution to the trust. When ending the Trust due to expiry of the trust period, the Trust will transfer said residual shares without contribution as a shareholder return to OMRON Corporation, who plans to cancel the shares by resolution of the Board of Directors.

(Reference)

[Details of the trust agreement]

| (1) | Type of trust | Money trust other than specific money trust individually managed (third-party-benefit trust) |

| (2) | Purpose of the trust | To provide incentive to Eligible Employees |

| (3) | Settlor | OMRON Corporation |

| (4) | Trustee | Mitsubishi UFJ Trust and Banking Corporation (provisional) (Co-trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) | Beneficiary | Eligible Employees who meet beneficiary requirements |

| (6) | Trust administrator | A third party with no vested interest in OMRON Corporation (certified public accountant) |

| (7) | Date of trust agreement | May 26, 2023 (provisional) |

| (8) | Trust period | May 26, 2023 (provisional) through August 31, 2025 (provisional) |

| (9) | Commencement date of the plan | May 26, 2023 (provisional) |

| (10) | Exercise of voting rights | Not to be exercised |

| (11) | Class of shares to be acquired | Common stock of OMRON Corporation |

| (12) | Amount of trust fund | 50 million yen (provisional) (includes trust fees and trust expenses) |

| (13) | Timing of share acquisition | May 31, 2023 (provisional) |

| (14) | Method of share acquisition | Disposal of treasury stock by OMRON Corporation by way of third-party allotment |

| (15) | Holder of vested rights | OMRON Corporation |

| (16) | Residual assets | Residual assets that can be received by OMRON Corporation, the holder of vested rights, shall be within the reserve for trust expenses, which is trust funds less share acquisition funds. |

Note: The timings planned above may be revised to the appropriate timings in view of applicable laws and regulations.

(end)

| Emitter: |

OMRON Corporation Shiokoji Horikawa, Shimogyo-ku 600-8530 Kyoto Japan |

|

|---|---|---|

| Contact Person: | Jan Hutterer | |

| Phone: | +49 172 3462831 | |

| E-Mail: | jan.hutterer@kirchhoff.de | |

| Website: | www.omron.com | |

| ISIN(s): | JP3197800000 (Share) | |

| Stock Exchange(s): | Regulated Market in Frankfurt; Free Market in Berlin, Hannover, Stuttgart | |

| Other Stock Exchanges: | NASDAQ, Tokio |