Business news for the stock market

ADX Energy Ltd.: Anshof Oil Development Funding and Participation Transaction Receives Ministerial Acceptance

Wien (pta024/05.09.2023/15:28 UTC+2)

"The way is clear for ADX and its new industry partner MND to progress with the immediate drilling of the Anshof-2 well"

Summary

- ADX previously announced on 7 August 2023 that MND Austria a.s. (MND) will a secure a 30% economic interest in the Anshof Field within the ADX-AT-II licence in Upper Austria by making the following payments to ADX VIE GmbH (ADX);

- payment of back costs of EUR 1.335 million (A$ 2.225 million) to ADX VIE GmbH (ADX)

- fund EUR 5.28 million (A$ 8.80 million) for the drilling, completion and tie-in of the Anshof-2 and Anshof-1 wells, and

- payment of further contingent Success Payments of EUR 1.335 million (A$ 2.225 million) to ADX and EUR 3.57 million (A$ 5.95 million) of further development funding if the Anshof-2 well meets agreed production performance criteria.

The total firm and contingent investment obligation is EUR 11.52 million (A$ 19.20 million).

- Confirmation of acceptance of the Anshof Field Area partnership documentation by the Austrian designated authority was a condition precedent for the transaction which has now been satisfied.

- ADX is now clear to progress the Anshof-2 appraisal and development well during the fourth quarter of 2023 with funding for its share of drilling costs provided by MND.

- The Anshof field has been independently assessed to contain 5.2 million barrels of gross oil equivalent (BOE) reserves – refer ASX Release dated 31 October 2022. The field is currently producing from the Anshof-3 discovery well at approximately 120 barrels of oil per day (BOPD).

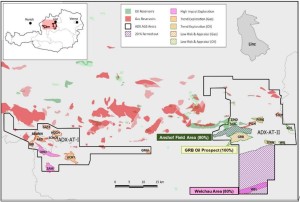

- Post investment by MND, ADX will remain operator and retain a 50% economic interest in the Anshof Field Area but has retained a 100% interest in adjacent oil prospects of similar resource potential to the Anshof field, such as the GRB appraisal project.

- MND and ADX have agreed, subject to contract, to conclude a further gas exploration investment in an area within the ADX-AT-I licence.

- The form of partnership documentation developed by ADX for the Anshof Field Area and accepted by the Austrian Authorities can be used for further co-investment opportunities in ADX Upper Austrian exploration acreage such as the Welchau Investment Area and the abovementioned planned investment by MND in an area within the ADX-AT-I licence.

ADX Executive Chairman, Mr Ian Tchacos, said,"The Board of ADX is very pleased by the rapid positive clearance of the Anshof partnership documentation by the Austrian designated authority which enables the completion of the transaction with MND. ADX will now proceed with the drilling of the Anshof-2 well with funding for its share of costs provided by MND. Anshof-2 has the potential to substantially increase production and reserves at Anshof. The documentation of the partnership model developed for Anshof also provides an accepted model for further co-investment transactions with MND and other parties in ADX' Upper Austrian exploration acreage where ADX has an extensive portfolio of drillable prospects that are attracting industry attention."

ADX Energy Ltd (ASX Code: ADX) is pleased to advise that a condition precedent for the Energy Investment Agreement (EIA) for the Anshof Field in the ADX-AT-II license between its wholly owned subsidiary ADX VIE GmbH (ADX VIE) and MND Austria a.s. (MND) has been satisfied by the clearance of the documentation for the Anshof partnership between ADX, MND and existing partner Xstate Resources Limited (XST) by the ministry of finance of the Republic of Austria (Bundesministerium für Finanzen or BMF).

Under the terms of the EIA, MND will make precompletion payments to ADX VIE of EUR 1,335,000 for back costs and EUR 597,353 for Anshof-1 and Anshof-2 well long lead items. The total firm and contingent investment payment obligations by MND are up to EUR 11,520,000 to earn a 30% economic interest in the Anshof Field Area (Refer to the ASX release dated 7 August 2023).

Upon payment of MND's funding obligations, ADX will remain operator and retain a 50% economic interest in the Anshof Field Area. MND and XST will hold a 30% and 20% economic interest, respectively. ADX will retain a 100% interest in the remainder of the ADX-AT-II exploration area other than the Welchau Area where ADX holds an 80% economic interest. Of particular relevance to the expansion of Anshof, ADX has retained a 100% interest in adjacent oil prospects such as GRB which has similar resource potential to Anshof (see Figure 1).

ADX will progress with the drilling of the Anshof-2 appraisal and development well during the fourth quarter of 2023 with funding provided by MND under the terms of the EIA. Success at the Anshof-2 well will result in a substantial increase in oil rate from the field as well as a Success Payment from MND. The Anshof-1 development well is planned to be drilled in the first half of 2024. The combination of Anshof-1, Anshof-2 and Anshof-3 is expected to deliver in aggregate an oil rate of approximately 750 to 1,000 BOPD assisted by high angle wells which are expected to result in high productivity and reserves recovery per well.

Partnership Documentation

The partnership documentation developed by ADX for the Anshof Field Area transaction which has been accepted by the BMF can be used further co-investment opportunities in ADX' Upper Austrian exploration acreage such as the Welchau Investment Area and the planned but not yet finalised gas exploration investment program by MND in part of the ADX-AT-I licence area.

Co-investment transactions with in ADX' Upper Austrian exploration acreage are an important element of ADX funding and risk mitigation strategy for exploration. ADX has an extensive portfolio of drillable prospects which is attracting industry attention for future co-investment.

About MND

The parent company of MND is MND a.s., a highly credentialled European energy company that generated approx. EUR 8.5 billion in revenue in 2022. MND a.s. businesses include Production & Exploration, Drilling and Services, Energy Storage and Energy Trading. The Company is active in the Czech Republic, Germany, Ukraine, Austria, Hungary, Slovakia and Hungary. Austria is a new country entry for their Exploration and Production Business.

For further details please contact:

| Paul Fink | Ian Tchacos |

| Chief Executive Officer | Executive Chairman |

| +61 (08) 9381 4266 | +61 (08) 9381 4266 |

| paul.fink@adx-energy.com | ian.tchacos@adxenergy.com.au |

Authorised for lodgement by Ian Tchacos, Executive Chairman

Persons compiling information about Hydrocarbons:

Pursuant to the requirements of the ASX Listing Rule 5.31, 5.41 and 5.42 the technical and reserves information relating to Austria and Italy contained in this release has been reviewed by Paul Fink as part of the due diligence process on behalf of ADX. Mr Fink is Technical Director of ADX Energy Limited is a qualified geophysicist with 30 years of technical, commercial and management experience in exploration for, appraisal and development of oil and gas resources. Mr Fink has reviewed the results, procedures and data contained in this release and considers the resource estimates to be fairly represented. Mr Fink has consented to the inclusion of this information in the form and context in which it appears. Mr Fink is a member of the EAGE (European Association of Geoscientists & Engineers) and FIDIC (Federation of Consulting Engineers).

Previous Estimates of Reserves and Resources:

ADX confirms that it is not aware of any new information or data that may materially affect the information included in the relevant market announcements for reserves or resources and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcements continue to apply and have not materially changed.

PRMS 2018 Reserves Classifications

1P Denotes low estimate of Reserves (i.e., Proved Reserves). Equal to P1.

2P Denotes the best estimate of Reserves. The sum of Proved plus Probable Reserves.

3P Denotes high estimate of Reserves. The sum of Proved plus Probable plus Possible Reserves.

- Developed Reserves are quantities expected to be recovered from existing wells and facilities.

- Developed Producing Reserves are expected to be recovered from completion intervals that are open and producing at the time of the estimate.

- Developed Non-Producing Reserves include shut-in and behind-pipe reserves with minor costs to access.

- Undeveloped Reserves are quantities expected to be recovered through significant future investments.

A. Proved Reserves are those quantities of Petroleum that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be commercially recoverable from known reservoirs and under defined technical and commercial conditions. If deterministic methods are used, the term "reasonable certainty" is intended to express a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate.

B. Probable Reserves are those additional Reserves which analysis of geoscience and engineering data indicate are less likely to be recovered than Proved Reserves but more certain to be recovered than Possible Reserves. It is equally likely that actual remaining quantities recovered will be greater than or less than the sum of the estimated Proved plus Probable Reserves (2P). In this context, when probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the 2P estimate.

C. Possible Reserves are those additional Reserves that analysis of geoscience and engineering data suggest are less likely to be recoverable than Probable Reserves. The total quantities ultimately recovered from the project have a low probability to exceed the sum of Proved plus Probable plus Possible (3P) Reserves, which is equivalent to the high-estimate scenario. When probabilistic methods are used, there should be at least a 10% probability that the actual quantities recovered will equal or exceed the 3P estimate. Possible Reserves that are located outside of the 2P area (not upside quantities to the 2P scenario) may exist only when the commercial and technical maturity criteria have been met (that incorporate the possible development scope). Standalone Possible Reserves must reference a commercial 2P project.

End of this Release

(end)

| Emitter: |

ADX Energy Ltd. Canovagasse 5 1010 Wien Austria |

|

|---|---|---|

| Contact Person: | DI Paul Fink | |

| Phone: | +43 (0)50 724 5666 | |

| E-Mail: | paul.fink@adx-energy.at | |

| Website: | www.adx-energy.com | |

| ISIN(s): | AU000000ADX9 (Share) | |

| Stock Exchange(s): | Free Market in Berlin, Frankfurt, Hamburg, Munich, Stuttgart, Tradegate | |

| Other Stock Exchanges: | Australian Securities Exchange (ASX), Sydney |