Ad hoc announcement according to article 53 KR

Georg Fischer AG: Strong performance - accelerating growth

Schaffhausen

(pta010/21.07.2021/07:00 UTC+2)

This is an ad hoc announcement pursuant to Article 53 of the Listing Rules (LR) of the SIX Exchange Regulation AG.

The full version of the GF Mid-Year Report 2021 incl. documentation is available on

www.georgfischer.com/mid-year-report.

Schaffhausen

21 July 2021, 7:00 a.m. CET

Strong performance - accelerating growth

- Sales rose organically 20% to CHF 1'835 million, supported by strong global markets

- Operating result (EBIT) increased 120% to CHF 141 million compared to previous year's EBIT before one-offs, resulting in a clearly improved EBIT margin of 7.7%

- Strategy 2025 with focus on sustainability and innovation in full swing

- Double-digit sales growth as well as a significant increase in profit expected for the year 2021

In the first semester of 2021, GF's business continued to show a significant recovery, following the challenges posed by the COVID-19 pandemic. As most of GF's key markets started to grow again, GF recorded strong sales at nearly the same level as prior to the pandemic, as well as a markedly increased profitability in all three divisions. However, the macroeconomic environment in which GF operates as a global company remains challenging, with continued pressure on supply chains, raw material scarcity and increasing prices, ongoing trade disputes, and globalization-related tensions. While these hurdles have hindered a full recovery of the business, other positive market and technology trends have supported GF's performance in the first half of the year.

GF is embracing the changes brought on by the COVID-19 crisis, for example by adopting and encouraging hybrid models of work and continuing to invest in digitalized products and processes. Virtual events and meetings have become the new normal and, thanks to these, the company has managed to maintain proximity to its customers and suppliers. Despite the restrictions, GF was able to count on the loyalty and strength of many relationships built over decades.

Corporate results

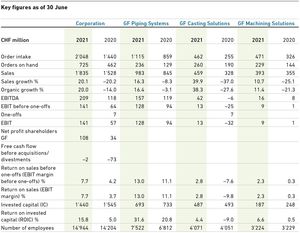

Order intake rose 42.2% to CHF 2'048 million from CHF 1'440 million in the first semester 2020. Sales amounted to CHF 1'835 million, a 20.1% increase compared with the first half of 2020, supported by strong global markets. Organic growth also stood at 20.0%. All three divisions contributed to this sales increase. Negative currency effects amounted to CHF 9 million.

The operating result (EBIT) rose 120% to CHF 141 million compared to the EBIT before one-offs in the prior-year period, with a corresponding EBIT margin of 7.7%. In the same period a year ago, these were CHF 64 million and 4.2%, respectively. Net profit attributable to shareholders of GF amounted to CHF 108 million, compared with CHF 34 million in the first half of 2020. Free cash flow before acquisitions/divestments was CHF -2 million, CHF 71 million above the previous year's result. Cash and cash equivalents stood at a high level of CHF 770 million.

GF Piping Systems

The division saw a very successful first semester, with high utilization at almost all plants. GF Piping Systems' strong recovery is mainly due to its presence in growth markets and segments, such as microelectronics, water and gas infrastructure, as well as in many promising applications, for example cooling for data centers and wastewater treatment. All regions, spearheaded by China, contributed to sales of CHF 983 million in the semester, a 16.3% increase compared with the first half of 2020. Organically, sales rose 16.4%, acquisitions added another CHF 11 million of sales. The operating result stood at CHF 128 million (H1 2020: CHF 94 million), for an expanded EBIT margin of 13.0% (H1 2020: 11.1%).The division is focusing its efforts on solutions with sustainability benefits to serve higher value businesses. An example is the non-destructive testing of pipe connections in the field of infrastructure installations. GF Piping Systems has been steadily expanding its footprint in fast-growing markets: the integration of FGS Brasil Indústria e Comércio Ltda. (FGS), Cajamar (Brazil), the acquisition of which was announced last year, is well on track. Construction of a modern plant in Yangzhou (China) is also progressing well, start of production is expected by the beginning of next year.

GF Casting Solutions

GF Casting Solutions recorded CHF 459 million in sales, a 39.9% increase, favored by a strong market rebound in the automotive sector in the first six months of 2021. Organically, sales rose 38.3%. The division also swung back to profit, reporting an EBIT of CHF 13 million (H1 2020 EBIT before one-offs: CHF -25 million) supported by strong markets in Asia and a good rebound in Europe (EBIT margin 2.8%, compared to -7.6% EBIT margin before one-offs in H1 2020). Nonetheless, the division's performance was affected by the rising costs of raw materials, which are contractually passed on to customers and only recouped with a time lag of approximately three months. Also affecting performance was the subdued demand in the US, due to adverse weather conditions and semiconductor shortages. This affected GF's light metal foundry in Mills River (US), which saw a reduction of call-offs and delayed ramp-ups of several orders as a consequence. China and Europe registered record demand for e-vehicles, resulting in a 69% increase of sales for e-mobility components compared to the first semester 2020, reflecting the strong strategic position of the division in this segment. Order intake at GF Casting Solutions' new light metal production facility in Shenyang (China) is picking up, and the new site, where production is expected to begin in 2022/2023, is well positioned to address the needs of the Chinese automotive market.

GF Machining Solutions

After the impact of the 2020 downturn, which saw demand for machine tools sink to a minimum, the situation changed and order intake at GF Machining Solutions reached a very promising level in the first six months of 2021. Segments such as medtech, ICT and high-precision solutions for e-mobility applications enjoyed strong demand whilst projects in the aerospace industry show signs of a slow but steady recovery. GF Machining Solutions reported sales of CHF 393 million in the first half of this year, compared with CHF 355 million in the prior-year period. The division achieved an organic increase of 45.2% in order intake resulting in a book-to-bill ratio of 1.2. Operating result reached CHF 9 million, despite several production sites in Europe and the US not yet operating at full capacity. This corresponds to an EBIT margin of 2.3% (H1 2020: 0.3%). GF Machining Solutions continues to be an industrial technology leader. Its innovations, such as its most advanced laser texturing and high end wire EDM technology, will be presented at the next leading trade fair, EMO, in Milan (Italy) (4 - 9 October). At the fair, the division will also introduce new digital solutions to enhance productivity and ease-of-use for its customers.

Strategy 2025: Rollout on track

Earlier this year, GF unveiled its new strategy cycle, a five-year plan to unleash the company's full potential. The Strategy 2025 implementation, which is already in full swing, addresses profitable growth, portfolio resilience, and a "go for the full potential" spirit to evolve into a performance and learning culture. GF employees play a pivotal role in the implementation of the strategy, with the ambition for the company to become a sustainability and innovation leader that provides superior customer value. GF's product range is increasingly geared towards sustainability benefits.

Sustainability drives performance

With the kick-off of the new strategy cycle, GF is striving to become a leader in what matters most: Sustainability is the foundation of GF's business and the core of innovative customer solutions, for example in the areas of water conservation, CO2 reduction and avoidance of hazardous materials. These will not only support our customers to reach their own sustainability goals, but also reinforce GF's long-term growth initiatives and the generation of a sustainable performance. The ongoing focus on strong governance will ultimately reduce risks and hence the cost of capital. The recently published Sustainability Report 2020 marks GF's 20th year of transparent reporting on ESG matters.

Outlook for the full year 2021

The recovery in the first half of this year is expected to continue, supported by a good order intake, especially in key markets, as well as a number of initiatives, including planned governmental infrastructure projects that aim to boost the global economy. Despite the uncertainties that will continue to persist, especially with regard to the impacts of the global supply chain constraints, and barring unforeseen circumstances including a COVID-19 resurgence, GF expects sales growth in the double-digits in 2021, as well as a substantial increase in profit.

To join the Conference call with Audio Webcast on Mid-Year Results 2021 on

Wednesday, 21 July 2021, at 10:00 am, please dial the numbers below.

Switzerland/Europe +41 (0) 58 310 50 00

UK +44 (0) 207 107 06 13

USA +1 (1) 631 570 56 13

For further information please contact

Beat Römer, Head Corporate Communications

+41 (0) 52 631 26 77, media@georgfischer.com

Jiri Paukert, Media Relations Manager

+41 (0) 52 631 26 79, media@georgfischer.com

GF uses certain key figures to measure its performance that are not defined by Swiss GAAP FER. For that reason, there might be limited comparability to similar figures presented by other companies. Additional information on these key figures can be found at

www.georgfischer.com/en/investors/alternative-performance-measures.html.

Corporate Profile

GF comprises three divisions: GF Piping Systems, GF Casting Solutions and GF Machining Solutions. Founded in 1802, the Corporation is headquartered in Switzerland and present in 34 countries with 137 companies, 59 of them production facilities. GF's 14'118 employees generated sales of CHF 3'184 million in 2020. GF is the preferred partner of its customers for solutions enabling safe transport of liquids and gases, lightweight casting components, and high-precision manufacturing technologies. More information is available at www.georgfischer.com.

You can register for our subscription service for journalists at www.georgfischer.com/aboservice. You will automatically receive our current media releases.

(end)

| Emitter: |

Georg Fischer AG Amsler-Laffon-Strasse 9 8200 Schaffhausen Switzerland |

|

|---|---|---|

| Contact Person: | Beat Römer | |

| Phone: | +41 52 631 26 77 | |

| E-Mail: | beat.roemer@georgfischer.com | |

| Website: | www.georgfischer.com | |

| ISIN(s): | CH0001752309 (Share) | |

| Stock Exchange(s): | SIX Swiss Exchange |