Business news for the stock market

ADX Energy Ltd.: Anshof Independent Assessment confirms 5.2 million barrels of 2P Reserves

ADX' 80% share of Anshof represents a 239% increase in the Company's Austrian 2P reserves

Wien (pta013/31.10.2022/10:00 UTC+1)

Anshof Independent Assessment confirms 5.2 million barrels of 2P Reserves note 1

ADX' 80% share of Anshof represents a 239% increase in the Company's Austrian 2P reserves

Key Points:

- RISC Advisory Pty Ltd ("RISC") has completed an independent audit of reserves and resources for the Anshof oil field in the (ADX-AT-II License, Upper Austria). RISC's report ("CPR") includes production forecasts, cost estimates, project economics and resulting valuations of reserves by category for the Eocene oil reservoirs at the Anshof field.

- The result of the RISC CPR for 2P (Proven + Probable) reserves category is summarised as follows;

- 2P (Proven + Probable) gross reserves1 estimated at 5.2 million barrels of oil equivalent as at 1 October 2022.

- The estimated Net Present Value (NPV8) of the 2P gross reserves is EUR 42.3 million (approx. A$ 67 million) in real terms. The NPV8 was calculated at RISC's oil price forecast of an average USD 71 per barrel and discounted at 8%.

- ADX forecasts improved well performance and therefore less production wells to fully develop Anshof than has been estimated by RISC. This has the potential to significantly enhance field economics.

- ADX' 80% net share of the Anshof 2P gross reserves increases ADX total reserves position by 239% to 5.90 million barrels of oil equivalent including the producing 100% owned Gaiselberg and Zistersdorf fields located in the Vienna Basin.

- Production recently commenced from the Anshof-3 discovery well at a controlled rate of 100 barrels of oil per day (refer to ASX release dated 24 October 2022).

ADX Executive Chairman, Mr Ian Tchacos, said: "The RISC CPR confirms the materiality and value of the Anshof field which is in line with the ADX predrill estimates. ADX is pursuing the development of the Anshof field with the ordering of long lead items for the drilling of the Anshof-1 and Anshof-2 wells from the same well site as the recently producing Anshof-3 well. Our goal is to significantly increase production and further appraise the reserves from the field. We are especially pleased that the RISC CPR provides an assessment of the large reserves and contingent resource potential of Anshof."

Note 1: Proved and Probable Development Justified Reserves including associated gas produced from the field assessed in accordance with SPE-PRMS 2018 Petroleum Resources Management System (refer table 1 for additional commentary).

ADX Energy Ltd (ASX Code: ADX), is pleased to advise the results of the Competent Person's Report ("CPR") undertaken by independent consultants RISC Advisory Pty Ltd ("RISC"). RISC was engaged to provide an independent reserve and resource assessment for ADX' Anshof field located within the ADX-AT-II licensefor exploration, production and gas storage in Upper Austria (Molasse Basin). The RISC CPR has an effective date of 1 October 2022. ADX holds an 80% participating interest in the Anshof field and a 100% interest in the remainder of the ADX-AT-II license. ADX also holds a 100% in the ADX-AT-I exploration license.

The Anshof field was discovered by the Anshof-3 well which was drilled, evaluated and cased in January 2022. Commercial crude oil production from the Eocene oil reservoirs at the Anshof-3 well was announced on the 24th of October 2022 after the effective date of the RISC CPR. Eocene oil at Anshof is a high quality (32° API) sweet crude. The scope of the RISC CPR does not include the shallower Miocene sandstone gas intervals encountered in the well.

Anshof Reserves and Resources Summary (RISC CPR)

The RISC CPR was conducted in accordance with SPE-PRMS 2018 with an effective date of 1 October 2022. The 1P, 2P and 3P Reserves have been classified as Undeveloped Reserves (Development Justified) and additional 3C Contingent Resources (Development Pending) have also been identified. A summary of the gross oil and gas reserves and resources for the Anshof field is below in Table 1.

Table 1: Anshof Reserves and Resources

| Oil & Gas Reserves | Oil (MMstb) | Gas (MMscf) | Total (MMboe) | ||||||

| 1P | 2P | 3P | 1P | 2P | 3P | 1P | 2P | 3P | |

| Anshof gross reserves | 0.4 | 5.0 | 12.0 | 96 | 1,169 | 2,812 | 0.5 | 5.2 | 12.5 |

| ADX net share | 0.3 | 4.0 | 9.6 | 76 | 935 | 2,250 | 0.4 | 4.2 | 10.0 |

| Oil & Gas Contingent Resources | Oil (MMstb) | Gas (MMscf) | Total (MMboe) | ||||||

| 1C | 2C | 3C | 1C | 2C | 3C | 1C | 2C | 3C | |

| Anshof gross Contingent Resources | 0 | 0 | 12.9 | 0 | 0 | 3,041 | 0 | 0 | 13.5 |

| ADX net share | 0 | 0 | 10.3 | 0 | 0 | 2,433 | 0 | 0 | 10.8 |

Notes:

| |||||||||

The key assumptions in the cases using deterministic methods, are summarised in Table 2 below.

Table 2: Anshof Reserves and Resources Key Assumptions

| Parameter | 1P | 2P | 3P | 3P & 3C |

| Oil contact (mTVDSS) | 1,581 | 1,720 | 1,720 | 1,940 |

| Field area (km2) | 0.5 | 6.4 | 6.4 | 25.4 |

| Oil in place (mmstb) | 2.4 | 19.4 | 19.4 | 83.2 |

| Production wells (RISC estimate)2 | 3 | 14 | 14 | 29 |

| Gross production volumes (mmboe) | 0.5 | 5.2 | 12.5 | 26.0 |

| NPV8 (100%) (EUR million) | -3.2 | 42.3 | 145.2 | 283.6 |

Notes:

| ||||

ADX Assessment Comparison

ADX estimation of likely well performance including production and recoverable volume per well, due to factors such as expected reservoir thickness and quality at future well locations and high angle well design, is significantly higher than RISC has estimated. ADX is planning for 5 production wells in the P50 case and 3 and 23 wells in the P90 and P10 cases respectively. Any well performance improvements, particularly in relation to oil recovery per well would reduce the number of production wells required to fully develop the field and improve the field economics.

Anshof Field Description and Resource Estimation Basis

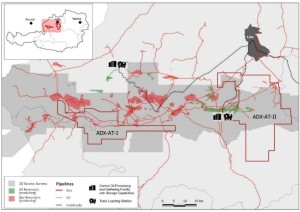

ADX is the Operator of the ADX-AT-I and ADX-AT-II exploration licenses in the Molasse Basin, Austria (Figure 1: ADX-AT-I and ADX-AT-II exploration licenses). ADX directly negotiated these licenses with the Austrian Mining Authority ("BMLRT") and the licensing agreements were executed on 8 January 2021.

The Anshof oil field was discovered by the Anshof-3 well which was drilled over the December 2021 to January 2022 period. The well intersected a 6 m gross, 2.1 m net oil reservoir interval in the primary Eocene objective.

Mapping of the Anshof structure was completed using modern 3D seismic (Figure 2: Anshof structure map based on 3D seismic). Reservoir parameters, as well as oil quality, was estimated from the Anshof-3 well and surrounding Eocene reservoir analogue wells. The field oil-water contact (OWC) range was estimated in the P90 case at a depth of 1581mSSTVD from the oil-down-to in the Anshof-3 well from which oil has been produced to surface. For the P10 OWC case a depth of 1940mSSTVD was taken from the HGN-001 well where oil shows were intersected. The oil-down-to intersection from the PK-005 well on the western edge of the Anshof structure (a third-party well which produces oil) supports our P50 OWC case depth of 1720mSSTVD and forms the basis for the ADX development planning.

Production from the Anshof-3 well commenced (after the effective date of the RISC CPR) through an early production system ('EPS') with oil trucked to a third-party gathering and processing facility at Voitsdorf-Zentrale, approximately 12 km by road. The EPS will be utilised until permanent facilities are put in place. The downdip Anshof-2 well is planned to be drilled in late 2023 and on confirmation of the 2Por deeper oil-water-contact permanent production and storage facilities will be constructed and installed at the field with an oil export pipeline in 2024. Production from both Anshof-2 and Anshof-3 wells will continue through an early production system until the pipeline is constructed. Further wells will be drilled as required to fully develop the field in 2024 and beyond.

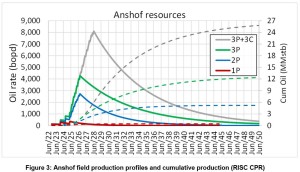

Recovery factors and production forecasts as determined by RISC are based on the productivity seen in Anshof-3 well test, and a review of nearby Eocene oil producers (Figure 3: Anshof field production profiles and cumulative production (RISC CPR) ). Wells will be pumped with sucker-rod pumps or electrical submersible pumps (ESP).

Economic parameters as determined by RISC are described below in Table 3. Capital expenditures (Capex) consist of wells and facilities and are dependent on the development scenario. Operating expenses (Opex) are broken down into third-party infrastructure and ADX components, which are broadly linked to production and well count.

Table 3: Anshof Reserves and Resources Key Assumptions

| Reserve Case | Economic Cut-off | Total Capex (EUR MM) | Total Opex (EUR MM) | NPV8 (EUR MM) |

| 1P reserves | 2032 | 16.3 | 11.7 | -3.2 |

| 2P reserves | 2038 | 72.6 | 96.3 | 42.3 |

| 3P reserves | 2045 | 72.6 | 241.6 | 145.2 |

| 3P + 3C | 2045 | 151.8 | 507.8 | 283.6 |

Notes:

| ||||

ADX Net Reserves and Resources

ADX Total Reserves and Contingent Resources Position is summarised below. This includes the Gaiselberg and Zistersdorf Reserves with an effective date of 1 July 2021.

A comparison of the current total ADX Reserves and Contingent Resources position as at 1 October 2022 and the previous ADX reserves position with an effective date of 1 July 2021, reported on 4 November 2021 is shown below in Table 4 below. The previously reported reserves adjusted to 1 October 2022 are calculated by deducting production from 1 July 2021 to 30 September 2022.

A positive variance of 239% is estimated for the 2P reserves category (refer to Table 4).

Table 4: ADX Current Reserves Position versus Previous Reserves Comparison for ADX Austrian Fields

| ADX Reserves and Contingent Resources Position (mmboe) – ADX Net Equity Interest | 1P | 2P | 3P | 3C |

| Gaiselberg and Zistersdorf (G&Z) Reserves at 1 July 20211 | 1.19 | 1.85 | n/a 2 | n/a2 |

| LESS Production (15 months) to 30 September 2022 | 0.11 | 0.11 | 0.11 | 0.11 |

| G&Z as at 1 October 2022 | 1.08 | 1.74 | n/a | n/a |

| Anshof Reserves & Resources (ADX net)2 | 0.4 | 4.2 | 10.0 | 10.8 |

| ADX Total Net Reserves and Resources | 1.48 | 5.90 | 10.0 | 10.8 |

| Reserves Increase | 37% | 239% | n/a | n/a |

Notes:

| ||||

PRMS 2018 Reserves Classifications used in this Release

1P Denotes low estimate of Reserves (i.e., Proved Reserves). Equal to P1.

2P Denotes the best estimate of Reserves. The sum of Proved plus Probable Reserves.

3P Denotes high estimate of Reserves. The sum of Proved plus Probable plus Possible Reserves.

- Developed Reserves are quantities expected to be recovered from existing wells and facilities.

- Developed Producing Reserves are expected to be recovered from completion intervals that are open and producing at the time of the estimate.

- Developed Non-Producing Reserves include shut-in and behind-pipe reserves with minor costs to access.

- Undeveloped Reserves are quantities expected to be recovered through significant future investments.

A. Proved Reserves are those quantities of Petroleum that, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be commercially recoverable from known reservoirs and under defined technical and commercial conditions. If deterministic methods are used, the term "reasonable certainty" is intended to express a high degree of confidence that the quantities will be recovered. If probabilistic methods are used, there should be at least a 90% probability that the quantities actually recovered will equal or exceed the estimate.

B. Probable Reserves are those additional Reserves which analysis of geoscience and engineering data indicate are less likely to be recovered than Proved Reserves but more certain to be recovered than Possible Reserves. It is equally likely that actual remaining quantities recovered will be greater than or less than the sum of the estimated Proved plus Probable Reserves (2P). In this context, when probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the 2P estimate.

C. Possible Reserves are those additional Reserves that analysis of geoscience and engineering data suggest are less likely to be recoverable than Probable Reserves. The total quantities ultimately recovered from the project have a low probability to exceed the sum of Proved plus Probable plus Possible (3P) Reserves, which is equivalent to the high-estimate scenario. When probabilistic methods are used, there should be at least a 10% probability that the actual quantities recovered will equal or exceed the 3P estimate. Possible Reserves that are located outside of the 2P area (not upside quantities to the 2P scenario) may exist only when the commercial and technical maturity criteria have been met (that incorporate the possible development scope). Standalone Possible Reserves must reference a commercial 2P project.

RISC Independence

RISC has no pecuniary interest, other than to the extent of the professional fees receivable for the preparation of their independent report, or other interest in the assets evaluated, that could reasonably be regarded as affecting our ability to give an unbiased view of these assets. RISC makes the following disclosures:

- RISC is independent with respect to ADX and confirms that there is no conflict of interest with any party involved in the assignment;

- Under the terms of engagement between RISC and ADX, RISC will receive a time-based fee, with no part of the fee contingent on the conclusions reached, or the content or future use of this report. Except for these fees, RISC has not received and will not receive any pecuniary or other benefit whether direct or indirect for or in connection with the preparation of this report;

- Neither RISC Directors nor any staff involved in the preparation of this report have any material interest in ADX or in any of the properties described herein.

RISC has conducted an independent audit of the developed Reserves and consented to the inclusion of information specified as RISC audited values in this release.

About RISC

RISC Advisory Pty is an independent advisory firm offering the highest level of technical and commercial advice to a broad range of clients in the energy industries, worldwide. RISC has offices in London, Perth, Brisbane and South-East Asia and has completed assignments in more than 90 countries for over 500 clients and have grown to become an international energy advisor of choice.

For further details please contact:

| Paul Fink | Ian Tchacos |

| Chief Executive Officer | Executive Chairman |

| +61 (08) 9381 4266 | +61 (08) 9381 4266 |

| paul.fink@adx-energy.com | ian.tchacos@adxenergy.com.au |

Authorised for lodgement by Ian Tchacos, Executive Chairman

End of this Release

(end)

| Emitter: |

ADX Energy Ltd. Canovagasse 5 1010 Wien Austria |

|

|---|---|---|

| Contact Person: | DI Paul Fink | |

| Phone: | +43 (0)50 724 5666 | |

| E-Mail: | paul.fink@adx-energy.at | |

| Website: | www.adx-energy.com | |

| ISIN(s): | AU000000ADX9 (Share) | |

| Stock Exchange(s): | Free Market in Berlin, Frankfurt, Hamburg, Munich, Stuttgart, Tradegate | |

| Other Stock Exchanges: | Australian Securities Exchange (ASX), Sydney |