Ad hoc announcement according to article 53 KR

Georg Fischer AG: Ad hoc announcement

Ad hoc announcement pursuant to Art. 53 of the Listing Rules (LR) of the SIX Exchange Regulation AG

Schaffhausen (pta007/20.07.2023/07:00 UTC+2)

Schaffhausen

20 July 2023, 7:00 a.m. CET

The full version of the GF Mid-Year Report 2023 incl. presentation is available at www.georgfischer.com/mid-year-report.

The presentation of the mid-year results will take place on 20 July at 10:00 a.m. via audio webcast.

Content of ad hoc announcement:

Good performance in challenging times, reflecting GF's strong position for long-term growth and value generation

- Sales at CHF 1'961 million (2022: CHF 1'971 million), organically up 7.5%, driven by strong market positions, continued demand for sustainable solutions and long-term megatrends

- Operating result came in at CHF 184 million (2022: CHF 179 million) with an EBIT margin up 30 basis points to 9.4%, within strategic corridor, despite strong currency headwinds

- Geopolitical tensions and challenging macroeconomic environment triggered muted development of selected markets and regions

- Strategy 2025 implementation on track, with tangible results; ESG key figures well in line with strategic targets

- Voluntary recommended cash tender offer for Uponor received positively among key stakeholder groups – successful completion of transaction would enable accelerated implementation of GF Piping Systems' Strategy 2025

In the first half of this year, GF's business continued to perform well, despite heavy currency headwinds and geopolitical tensions. Sales of sustainable products and solutions, underpinned by long-term megatrends such as urbanization, energy efficiency and high demand for clean drinking water, continue to sustain performance and profitability.

GF's solid financial position and global footprint, as well as the successful implementation of its Strategy 2025, are positioning the company well to weather expected recessionary trends in the global construction industry, subdued gas utilities in Europe and weaker ICT markets in Asia.

GF continues to actively drive innovation and sustainability. In April, it inaugurated two production sites in Shenyang and Yangzhou (both in China) that combine state-of-the-art production technology and the highest environmental standards in the production of lightweight car components and innovative piping systems. In Switzerland, GF officially unveiled its completely refurbished headquarters in Schaffhausen in June, featuring a modern, open space office, high sustainability standards and plenty of room for collaboration and innovation.

Through its Clean Water Foundation and long-standing partner Water Mission, GF was also able to quickly mobilize financial and material aid in early 2023 for survivors of a devastating earthquake in Turkey, helping increase access to clean water.

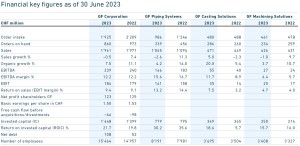

Corporate results

Sales amounted to CHF 1'961 million (2022: CHF 1'971 million), slightly below the previous year's level. This represents solid organic growth of 7.5%, supported by strong global demand for sustainable solutions. Negative currency effects had a substantial impact of CHF 123 million, partially offset by price adjustments.

The operating result (EBIT) rose to CHF 184 million, with a corresponding EBIT margin of 9.4%. In the first half of 2022, these were CHF 179 million and 9.1%, respectively. Net profit attributable to GF shareholders amounted to CHF 123 million, compared with CHF 125 million in the first half of 2022. Free cash flow came in at minus CHF 131 million (2022: minus CHF 37 million). Before acquisitions/divestments, the free cash flow was minus CHF 66 million (2022: minus CHF 98 million).

All three divisions were able to generate value in the first half of the year. The shift toward less cyclical businesses makes GF Casting Solutions and GF Machining Solutions in particular more resilient.

GF continues to jointly report financial and non-financial KPIs, underscoring the importance of a holistic business approach to both financial success and sustainability. GF is on track to reach its ESG targets for the year, including total sales with social and environmental benefits, a reduction in CO2 emissions, a reduction in waste and water intensity, as well as its targets for diversity and inclusion. In April 2023, GF was again included in "the top 100 companies globally" in the third edition of Europe's Climate Leaders – a listing by the Financial Times of the companies that are leading the way in tackling the negative impacts of climate change.

GF Piping Systems

The division saw lower demand in its Building Technology and Gas Utility business, however, its presence in growth markets and segments, such as high-end microelectronics production and process automation for water reclamation and treatment, made up for it. Sales amounted to CHF 1'065 million in the first half of 2023 (2022: CHF 1'094 million), representing an organic increase of 4.2%. The operating profit came in at CHF 141 million (2022: CHF 158 million), for an EBIT margin of 13.2% (2022: 14.4%).

In June, GF Piping Systems announced it had received Intel's EPIC Distinguished Supplier Award, a milestone that highlights the division's customer focus and commitment to excellence, and rewards a consistent level of strong performance.

With its state-of-the-art manufacturing layout for the production of process automation applications, its clean room for pre-fabrication and the modern training center, the newly inaugurated site in Yangzhou (China) is ready to meet the increasing customer demand for sustainable solutions.

In July 2023, GF Piping Systems received the EcoVadis gold medal for its sustainability performance. This award positions the division among the top 5% of companies assessed worldwide.

GF Casting Solutions

Growth in sustainable mobility reached an all-time high, with 86% of high-pressure die casting lifetime order intake related to e-vehicles. Sales reached CHF 471 million (2022: CHF 449 million), an organic increase of 20.0%, due in part to strong demand for e-vehicles. Operating profit increased substantially to CHF 35 million (2022: CHF 14 million), for an EBIT margin of 7.5% compared with 3.2% in 2022. The division is increasingly recognized for its innovation strength and capabilities to produce mega castings, which are a key differentiator in the production and assembly of e-vehicles. The ramp-up of the factory in Shenyang (China) is also progressing according to plan.

GF Casting Solutions earned its first EcoVadis gold medal for its sustainability performance in March 2023. This award positions the division among the top 4% of companies in the "Casting of Metals Industry" segment.

GF Machining Solutions

Considering the current demanding macroeconomic environment, GF Machining Solutions achieved a good order intake of CHF 461 million (2022: CHF 478 million), resulting in a book-to-bill ratio of 1.1. Sales reached CHF 426 million in the first half of this year (2022: CHF 431 million), organically up 3.7%, thanks to a rebound in the aerospace sector, where global order intake returned to pre-COVID-19 levels. Operating profit reached CHF 20 million (2022: CHF 17 million), leading to an EBIT margin of 4.7% (2022: 4.0%), supported by a strong MedTech segment and a high share of innovative solutions in the EDM technology.

The division continues to be an industrial technology leader, pursuing its strategy to strengthen customer experience and service offerings, including digital services.

GF Machining Solutions launched new high-performance laser machines for applications in several segments. One of these applications is anti-scratch surfaces on plastic components, where laser textured molds make it possible to reduce plastic coating chemicals, a big step in the sustainability journey of its customers.

Tender offer launched to acquire leading Finnish company Uponor

On 12 June 2023, GF announced its voluntary recommended cash tender offer to acquire the Finnish company Uponor, which, if successful, will pave the way for GF to become a global leader in the Water and Flow Solutions business, and increase its resilience and growth prospects. This is a transformative step for GF, which, upon successful completion, will accelerate the execution of its Strategy 2025 to drive profitable growth. The transaction is expected to close in Q4 2023.

Outlook for the full year 2023

The present volatile environment is likely to persist in the short term, but with a different situation per market segment. GF Piping Systems is dealing with a subdued worldwide construction industry, and gas utilities in Europe and Asia are facing headwinds. At the same time, the industrial segments are continuing to enjoy good momentum globally. GF Casting Solutions' good position in the e-vehicle and high-end segments is expected to support its business, also in the second half of the year. GF Machining Solutions faces subdued ICT markets, especially in China, but MedTech and aerospace order intakes are solid.

Overall, GF is set to benefit from strong positions in resilient market segments. In particular, the sustainability needs of our customers continue to offer excellent long-term business opportunities. Barring unforeseen circumstances, for the full year 2023 GF expects to achieve organic sales growth in line with its Strategy 2025and an operating profitability within the Strategy 2025 corridor (EBIT margin 9-11%).

GF uses certain key figures to measure its performance that are not defined by Swiss GAAP FER. Comparability to similar figures presented by other companies might therefore be limited. Additional information on these key figures can be found at www.georgfischer.com/en/investors/alternative-performance-measures.html.

(end)

| Emitter: |

Georg Fischer AG Amsler-Laffon-Strasse 9 8200 Schaffhausen Switzerland |

|

|---|---|---|

| Contact Person: | Beat Römer | |

| Phone: | +41 52 631 26 77 | |

| E-Mail: | beat.roemer@georgfischer.com | |

| Website: | www.georgfischer.com | |

| ISIN(s): | CH1169151003 (Share) | |

| Stock Exchange(s): | SIX Swiss Exchange |