Business news for the stock market

ADX Energy Ltd.: ADX Secures Farm-in Funding to drill the Giant Welchau Gas Prospect in Upper Austria

Kepis & Pobe Financial Group Inc. has committed to fund in the Welchau farmin area

Wien (pta025/29.11.2022/11:32 UTC+1)

"Kepis & Pobe Financial Group Inc., a leading Canadian energy finance and development group, has committed to fund 50% of well costs to earn a 20% participating interest in the Welchau farmin area"

Key points:

- Kepis & Pobe Financial Group Inc. (KPFG) will fund up to a cap of 50% of the cost of the Welchau-1 exploration well (Farmin Funding) to earn a 20% equity interest in the Welchau Farmin Area, which is a part of ADX' ADX-AT-II exploration license in Upper Austria (refer figure 1). The Welchau-1 well cost is budgeted to be EUR 3,810,000 (A$ 5,910,000).

- KPFG may also elect to fund a further 50% of the Welchau-1 well cost to earn a further 20% equity interest in the Welchau Farmin Area (Option). The Option election must be made by 21 January 2023.

- Within 10 days KPFG will make an initial payment to fund 50% of the Pre-drill Well Costs being EUR 197,000 (A$ 305,000) and pay a fee of EUR 100,000 (A$ 155,000) for the Option. If KPFG elects to exercise the Option, the fee will be offset against the additional payment for 50% of Pre-drill Well Costs.

- In addition to the Farmin Funding, KPFG will pay EUR 228,000 (A$ 354,000) for back costs relating to the Welchau prospect and the Molln appraisal opportunity. The parties have agreed to an ongoing work program of studies reviewing the potential for the appraisal of the Molln-1 gas discovery adjacent to the Welchau prospect.

- If the Welchau-1 well results in the development of a gas project, the Farmin Funding will be repaid to KPFG from 50% of net revenue generated from Welchau gas sales until pay back and the remaining revenue being distributed in accordance with each party's equity interest.

- The Welchau prospect has the potential to contain an 807 Billion Cubic Feet (BCF) equivalent (approx. 134 MMBOE) best technical prospective resource (note1) (Refer ASX release dated20 June 2022).Welchau is located up-dip from a gas discovery (Molln-1 well) drilled in 1989 which intersected at least a 400 m gas column, with 900 meters interpreted from pressure data and tested condensate rich, pipeline quality gas (40 barrels per mmcf and maximum flowrate of 3.5 mmcfpd) (refer to Figure 2). The Welchau prospect is relatively shallow (less than 2000 m) and within tie-in distance to the national gas pipeline network (approx. 18 km).

ADX Executive Chairman, Mr Ian Tchacos, said, "The Board of ADX is delighted to partner with Kepis & Pobe Financial Group Inc. to explore the Welchau gas prospect. The Principals of KPFG have a strong financing and technical background, are proven oil and gas operators in Europe with an exceptional track record as co-founders of Bankers Petroleum and BNK Exploration. KPFG shares our enthusiasm for the tremendous opportunity presented at Welchau to deliver a large new gas discovery to the market within Western Europe. The competitive terms achieved for the farmout of the Welchau prospect reflect its very large gas resource potential located in the heart of Europe, the relatively shallow drill depth and the close proximity to open access gas export infrastructure."

Note 1: The prospective resource estimates in this release are classified and reported in accordance with the PRMS – SPE Guidelines for the exploration licenses ADX-AT-I and ADX-AT-II, in the Molasse Basin, Austria. Refer to the end of this release for an explanation of prospective resource classifications used and the basis on which the prospective resources were estimated. Prospective Resources are those estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) related to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further explorations appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

ADX Energy Ltd (ASX Code: ADX) is pleased to advise that is has signed a Joint Development Agreement (JDA) with Kepis & Pobe Financial Group Inc.(KPFG) to fund the drilling of the Welchau gas prospect in ADX-AT-II exploration license in Upper Austria. The Welchau-1 well drilling expenditure is budgeted at up to EUR 3,810,000 (A$ 5,910,000).

Under the terms of the JDA, KPFG will fund 50% of the Welchau-1 well drilling expenditure to earn a 20% equity interest in the Welchau Farmin Area. On or before 21 January 2023, KPFG may elect to fund a further 50% of the Welchau-1 well drilling cost to earn a further 20% equity interest in the Welchau Farmin Area (Option).

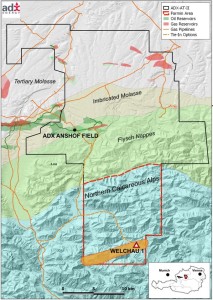

The Welchau Farmin Area is located within the thrust belts of the Northern Calcareous Alps portion of the ADX-AT-II license to the south of the ADX operated Anshof field (refer to Figure 1) discovered by the Anshof-3 well drilled in January 2022. The Welchau prospect which is located in the foothills of the Austrian Alpes is analogous to the giant Apennine thrust belt gas fields of Italy (Monte Alpi, Temparossa) and the Zagros thrust belts fields of Northern Kurdistan.

Within 10 days after execution of the JDA, KPFG will make a payment to fund 50% of the Pre-drill Well Costs being EUR 197,000 (A$ 305,000) which include engineering, planning, insurance, and long lead items for the Welchau-1 well and pay a fee of EUR 100,000 (A$ 155,000) for the Option. Should KPFG elect to exercise the Option the fee paid by KPFG will be offset against the payment of further Pre-drill Well Costs.

In addition to the Farmin Funding described above, KPFG will make a payment of EUR 228,000 (A$ 354,000) to ADX for back costs relating to subsurface studies associated with the opportunity to appraise the Molln gas discovery located within the Welchau Farmin Area. The parties have agreed a work program for reviewing the potential of the Molln-1 gas discovery as a follow up to or in conjunction with Welchau. The results of the Welchau well are likely to provide important information regarding the potential of Molln.

If the Welchau well results in the development of a gas project, the Farmin Funding will be repaid to KPFG from 50% of net revenue recovered from Welchau gas sales until pay back and the remaining revenue will be distributed in accordance with each party's equity interest in the Welchau Farmin Area. The JDA contains production sharing agreement principles and joint operating agreement principles which the parties will finalise into executable agreements shortly after execution of the JDA.

Assuming KPFG exercises its Option to fund the entire Welchau-1 well cost, at the completion of its farmin obligations, KPFG will hold 40% equity interest and ADX will retain a 60% equity interest in the Welchau Farmin Area. ADX retains an 80% equity interest in the Anshof field and a 100% equity interest in the remainder of the ADX-AT-II exploration license as well as the entire ADX-AT-I exploration license.

Welchau Gas Prospect Summary

The Welchau gas prospect has best technical resources estimated by ADX at 807 BCFE (134 MMBOE) (Note 1). It is potentially connected to an accidental gas discovery at the Molln-1 well which was drilled and extensively tested in the late 1980's. The Molln-1 tested pipeline quality gas at a rate of up to 3.5 mmcfpd down dip from the Welchau proposed drilling location.

The gas prospect is located in the foothills of the Austrian Alps and is analogous to the large anticline structures discovered in Kurdistan and the Italian Apennines. Welchau is a relatively shallow prospect (approx. 1120 m TVD). There is excellent access to the planned drilling location via roads and a short tie-in distance to the national gas pipeline network (approx. 18 km).

The main target at Welchau is the Triassic Steinalm Formation, a fractured carbonate reservoir trapped in a trending ramp anticline with more than 20 km lateral extent and 100 km2 maximum closure area. The structure is defined by extensive outcrop mapping and balanced 2D cross sections along a profile parallel to the shortening direction

ADX prospective resource estimates for the Welchau prospect are summarised below.

Welchau Gas Prospect Prospective Recoverable Resources Estimates | ||||

| Minimum | Best Technical | Maximum | ||

| Gas | BCF | 171 | 651 | 1315 |

| Oil equivalent | BOE | 29 | 108 | 219 |

| Condensate | BBIs | 6.8 | 26 | 52.6 |

| Total Oil Equivalent | BOE | 35 | 134 | 272 |

| Total Gas Equivalent | BCFE | 212 | 807 | 1631 |

| Mcf per BBl conversion used | 6 | |||

The original Resources Reporting Date for Welchau prospective resources was on 16 May 2022, the estimates were further revised on 20 June 2022.

The Molln-1 well located down dip of Welchau was drilled and tested in 1989. The results from this nearby well have significantly reduced risk in the following areas;

- Gas quality and gas charge has been demonstrated by gas flows during testing that also confirmed a high condensate yield (40 barrels per mmcf);

- Reservoir productivity of Triassic Steinalm Formation which was tested at 3.5 mmcfpd; and

- The quality of the top seal to hold a large gas column (900 meters interpreted from pressure and well test data, minimum 400 meters).

Welchau Well Planning

ADX has determined a well location for the Welchau-1 well and is in the process of finalising an agreement with the landowner. ADX can now commence permitting of the Welchau-1 well. ADX has also purchased long lead items for the well such as wellhead components and casing material with a view to drilling the Welchau-1 well as soon as practically possible. ADX expects to be in a position to advise on the likely well timing of drilling operations in the near future once a drilling rig slot has been finalised.

About Kepis & Pobe Financial Group Inc.

Kepis & Pobe Financial Group Inc. (KPFG) is a Canadian private investment platform based in Vancouver and focused on the energy sector. KPFG was founded in 2001. KPFG is establishing a vehicle to actively explore and develop new natural gas discoveries in Western Europe. The principals and advisors have a strong technical and financial background and are proven oil and gas operators in Europe. They include co-founders of Bankers Petroleum, BNK Exploration and InterOil Corporation all of which provided exceptional returns for investors.

Ford Nicholson, Managing Director of KPFG, said, "The race for high-quality hydrocarbon assets in Europe is on. The Welchau area is a potentially significant asset in one of Europe's safest jurisdictions."

ADX believes that KPFG will not only be an excellent partner but will also help bring new capital market attention to Welchau's exceptional gas potential in energy starved Western Europe.

Figures

Figure 1: Map showing ADX-AT-II license area, the Welchau Farmin Area (Red Dashed Border), the Welchau-1 drilling location in the Northern Calcareous Alps as well as the recently discovered and now producing Anshof oil field to the north.parallel to the shortening direction.

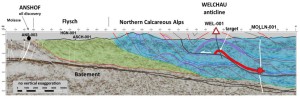

Figure 2: Geoseismic Cross Section showing the Molln-1 well in the south, the giant Welchau thrust anticline and the ADX Anshof-3 production well in the north. Note that the Molln-1 well was targeting an Anshof play type at ca. 5700 meters of depth but accidentally made a significant gas discovery (red highlight) much shallower within the thrust belts of the Northern Calcareous Alps which will also be targeted at Welchau.

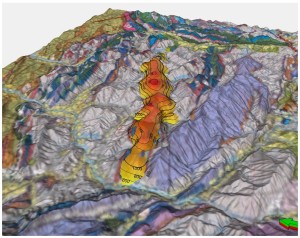

Figure 3: Surface expression of the Welchau anticline with 23 km lateral extension and 100 km2 area.

Figure 4: Schematic cross section of the Welchau gas prospect and the Molln-1 gas discovery.

Figure 5: Molln-1 well gas test in 1989

For further details please contact:

| Paul Fink | Ian Tchacos |

| Chief Executive Officer | Executive Chairman |

| +61 (08) 9381 4266 | +61 (08) 9381 4266 |

| paul.fink@adx-energy.com | ian.tchacos@adxenergy.com.au |

Authorised for lodgement by Ian Tchacos, Executive Chairman

Persons compiling information about Hydrocarbons:

Pursuant to the requirements of the ASX Listing Rule 5.31, 5.41 and 5.42 the technical and reserves information relating to Austria contained in this release has been reviewed by Paul Fink as part of the due diligence process on behalf of ADX. Mr. Fink is Technical Director of ADX Energy Ltd is a qualified geophysicist with 25 years of technical, commercial and management experience in exploration for, appraisal and development of oil and gas resources. Mr. Fink has reviewed the results, procedures and data contained in this release and considers the resource estimates to be fairly represented. Mr. Fink has consented to the inclusion of this information in the form and context in which it appears. Mr. Fink is a member of the EAGE (European Association of Geoscientists & Engineers) and FIDIC (Federation of Consulting Engineers).

Reporting Standards for Resource Estimation

Reserves and resources are reported in accordance with the definitions of reserves, contingent resources and prospective resources and guidelines set out in the Petroleum Resources Management System (PRMS) prepared by the Oil and Gas Reserves Committee of the Society of Petroleum Engineers (SPE) and reviewed and jointly sponsored by the American Association of Petroleum Geologists (AAPG), World Petroleum Council (WPC), Society of Petroleum Evaluation Engineers (SPEE), Society of Exploration Geophysicists (SEG), Society of Petrophysicists and Well Log Analysts (SPWLA) and European Association of Geoscientists and Engineers (EAGE), revised June 2018.

Prospective Resource Classifications

Low Estimate scenario of Prospective Resources - denotes a conservative estimate of the quantity that will actually recovered from an accumulation by an oil and gas project. When probabilistic methods are used, there should be at least a 90% probability (P90) that the quantities actually recovered will equal or exceed the low estimate.

Best Estimate scenario of Prospective resources - denotes the best estimate of the quantity that will actually be recovered from an accumulation by an oil and gas project. It is the most realistic assessment of recoverable quantities if only a single result were reported. When probabilistic methods are used, there should be at least a 50 % probability (P50) that the quantities actually recovered will equal or exceed the best estimate.

High Estimate scenario of Prospective Resources - denotes an optimistic scenario of the quantity that will actually be recovered from an accumulation by an oil and gas project. When probabilistic methods are used, there should be at least a 10% probability that the quantities actually recovered will be equal or exceed the high estimate.

ADX has only reported Best Estimate Prospective Resources Scenarios in this release.

Nomenclature and conversions used in this release

BBL means US barrel

MMBBLS means millions of US barrels.

MCF means thousand cubic feet

MMCF means million cubic feet

BCF means billion cubic feet

TCF meanstrillion cubic feet

BOE means barrels of oil equivalent

MMBOE means millions of barrels of oil equivalent

Oil to gas energy equivalent conversion: 1 BBL = 6 MCF

End of this Release

(end)

| Emitter: |

ADX Energy Ltd. Canovagasse 5 1010 Wien Austria |

|

|---|---|---|

| Contact Person: | DI Paul Fink | |

| Phone: | +43 (0)50 724 5666 | |

| E-Mail: | paul.fink@adx-energy.at | |

| Website: | www.adx-energy.com | |

| ISIN(s): | AU000000ADX9 (Share) | |

| Stock Exchange(s): | Free Market in Berlin, Frankfurt, Hamburg, Munich, Stuttgart, Tradegate | |

| Other Stock Exchanges: | Australian Securities Exchange (ASX), Sydney |